Volatility is one of the key assumptions that goes into the valuation of stock-based compensation. Private companies may use the volatility of similar peer companies to estimate the volatility of their own stock price. Although there is no explicit guidance as to what specific companies should be used but we do see a lot of companies use the same set of peer companies from their 409a valuations to also value their stock options for stock-based compensation.

It is common for the peer set within a 409a valuation to change. This article will go over how the peer company settings within Carta's Financial Reporting module works and how they can be adjusted to have the peer set match their 409a valuations.

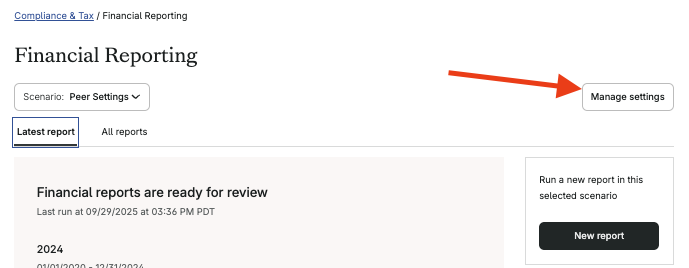

The public peer company settings are located within the "Manage Settings" section.

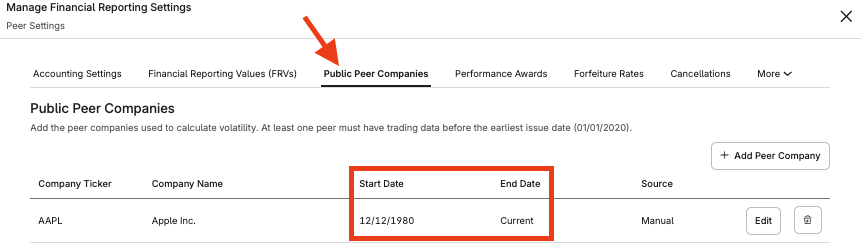

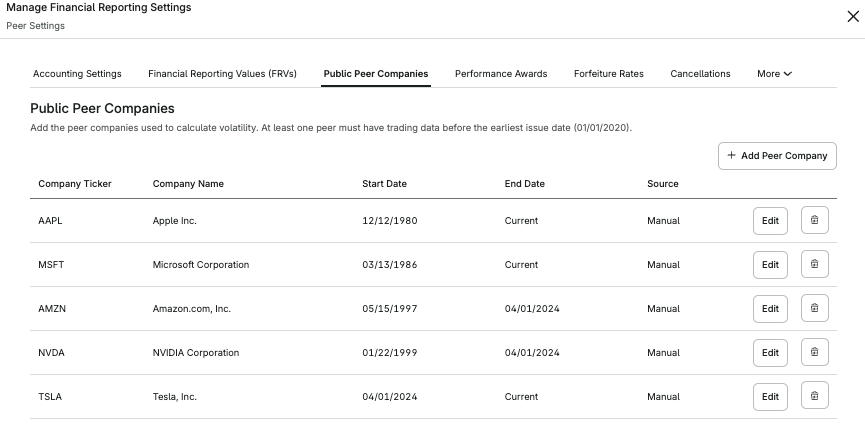

Carta shows the Start Date and End Date of each peer company. What this means is that the peer company will be used for the volatility calculation if the stock option's grant date falls between the Start Date and End Date. For example, AAPL will be used as a peer company if the stock option was issued between 12/12/1980 and today.

Let's say that a company has historically used the following peer companies to value volatility:

- AAPL - Apple Inc.

- MSFT - Microsoft Corporation

- AMZN - Amazon.com, Inc.

- NVDA - NVIDIA Corporation

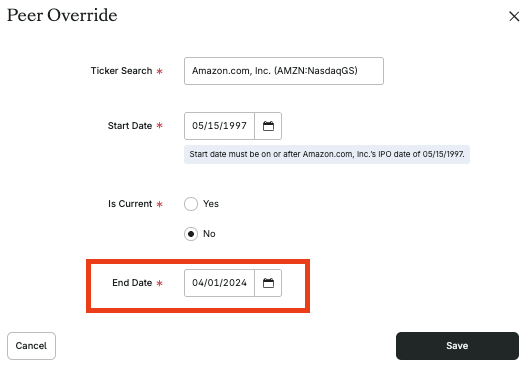

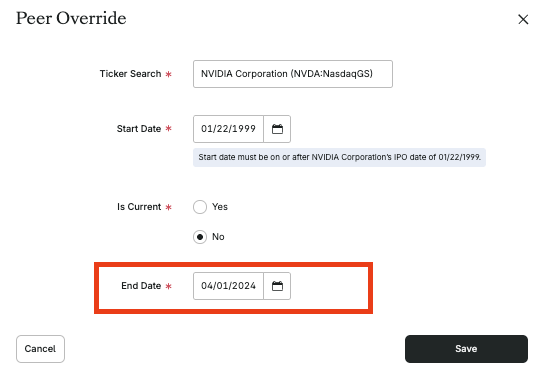

Then on 4/1/2024, the company received a new 409a valuation which uses this set of peer companies:

- AAPL - Apple Inc.

- MSFT - Microsoft Corporation

- TSLA - Tesla, Inc.

If the company wants to value its stock options issued on or after 4/1/2024 using this updated peer set, the company can enter a custom End Date for AMZN and NVDA as they are no longer part of the peer set.

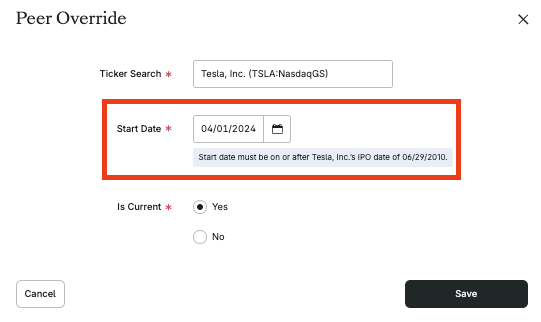

In addition, the company can enter a custom Start Date for TSLA to have this new peer company be used for volatility only for stock options issued on or after the 4/1/2024 409a valuation.

This is what the end result would look like:

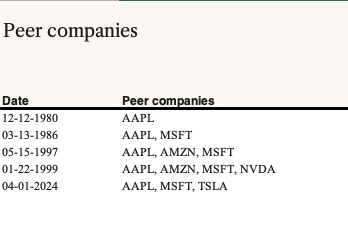

Within the SBC Expense Report, there is a Peer Companies worksheet that lists each unique set of peer companies based upon each individual peer's Start Date and End Date.

What the above table means is that stock options granted on or after 1/22/1999 will have their volatility measured against AAPL, AMZN, MSFT, and NVDA. Stock options issued on or after 4/1/2024 will no longer have their volatility valued against AMZN and NVDA but still valued against AAPL, MSFT along with a new peer company TSLA.

This is how a company can structure the peer settings to have a specific set of peer companies used to measure volatility of stock options based on when the stock option was granted.