Why are different volatility and interest rate values being used to value stock options granted on the same date?

Volatility represents the change in the value of stock over a specific period of time. The interest rate represents the risk-free interest that can be earned over a specific period of time. The specific period of time used in the Black Scholes option-pricing model is the expected term of an award.

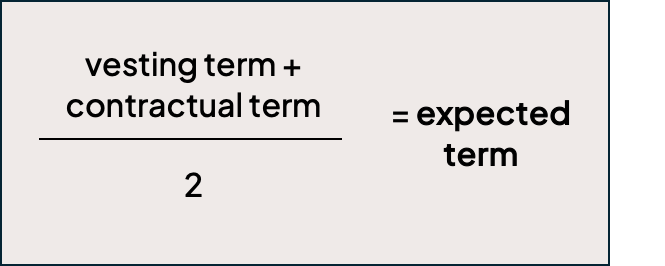

Carta calculates the expected term on the grant date using the SAB107 method, which is an average of the stock option’s vesting term and the contractual term:

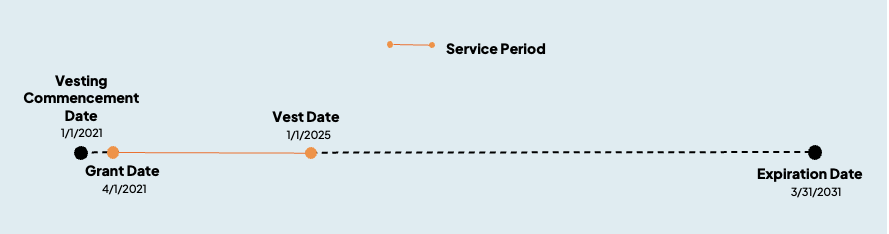

In many cases, the vesting commencement date begins on the employee’s hire date while the grant date is established later upon board approval. When measuring the vesting term on the grant date, an earlier vesting commencement date would result in a shorter vesting period and ultimately a shorter expected term.

Example

Let’s look at how the expected term would be different for two stock options both granted on the same day but begin vesting at different times.

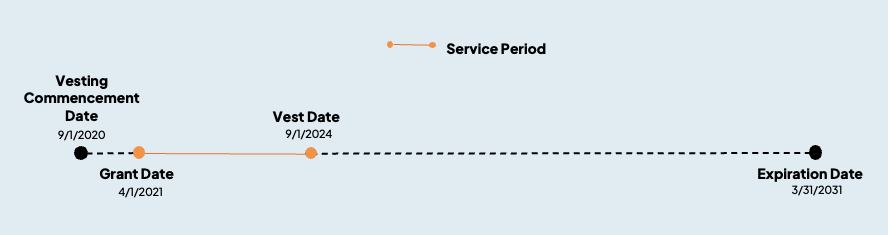

Employee #1 was hired on 9/1/2020 and will fully vest the stock option after 4 years of service on 9/1/2024.

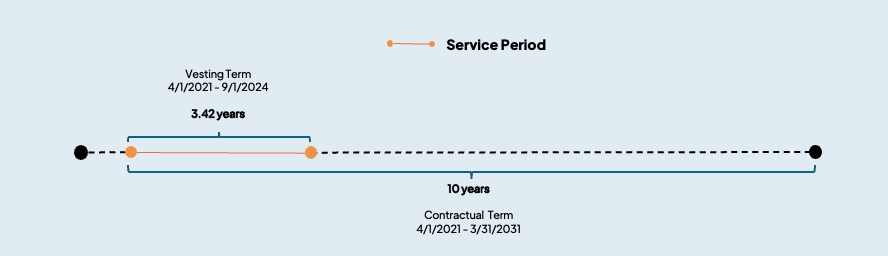

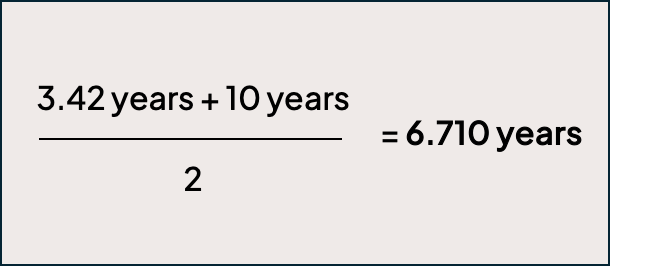

As of the grant date, the award will fully vest in 3.42 years and contractually expire 10 years.

Carta calculates the expected term of this award to be 6.710 years, the average of a 3.42 year vesting term and a 10 year contractual term.

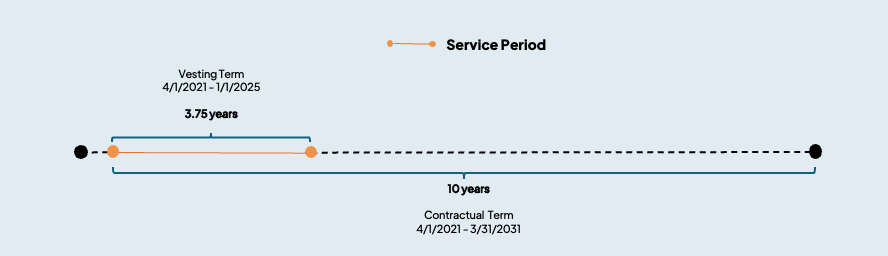

Employee #2 was hired on 1/1/2021 and will fully vest the stock option after 4 years of service on 1/1/2025.

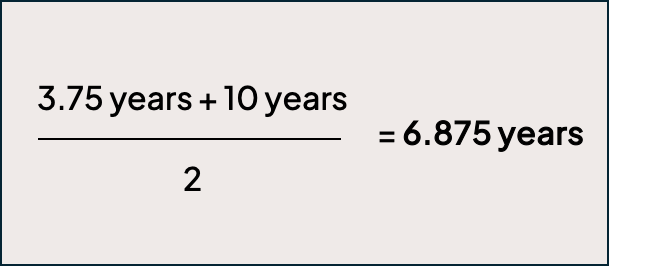

As of the grant date, the award will fully vest in 3.75 years and contractually expire 10 years.

Carta calculates the expected term of this award to be 6.875 years, the average of a 3.42 year vesting term and a 10 year contractual term.

Ultimately, awards with a different expected term will have a different measurement of volatility and interest rate.

For additional questions about how Carta calculates the expected term, volatility, interest rate, or values in the SBC Expense Report or Min. Disclosure Report, please reach out to us at 718@carta.com.